As the world races to harness the power of artificial intelligence, a new kind of war is beginning to unfold over AI infrastructure.

With the $254.5 Bn market for AI accelerating at 36.89% a year to scale $1.68 Tn in five years, it is making up a substantial chunk of the 402.74 Mn Terabytes of data that the world produces every day. One terabyte equals to 10 followed by 20 zeroes of bytes.

This is where infrastructure comes into play in a big way. AI data centres (DCs), the massive facilities that help store, train, and process data and AI models, have thrown up a $17.73 Bn opportunity that’s expanding at nearly 27% annually.

India, with its digital economy making up 13.42% of the national income, leads the AI race in skill penetration, and has emerged as the fastest-growing developer population, being home to 16% of the world’s AI talent, which reaffirms its growing influence in AI innovation and adoption.

“Global tech giants are planning to widen their DC footprint in India to not only cater to the strong local demand, but also to serve Global South,” said Sunil Gupta, cofounder and CEO of DC provider Yotta.

While hyperscalers like Google, Microsoft, and Amazon are expanding their capacities, homegrown players like Yotta, AdaniConneX, Reliance, and Hiranandani Group too are bolstering their games, quietly turning India into a strategic hub for AI infrastructure. Expected to grow over 10 times to reach $17 Bn by 2030, India’s AI landscape has emerged as a throbbing market for data centre demand, attracting even the likes of Anthropic and OpenAI to work out their gameplan.

While this race to set up data centres in India is reminiscent of the clash of hyperscalers for cloud services in 2015-16, there is a growing need for larger space and more power this time.

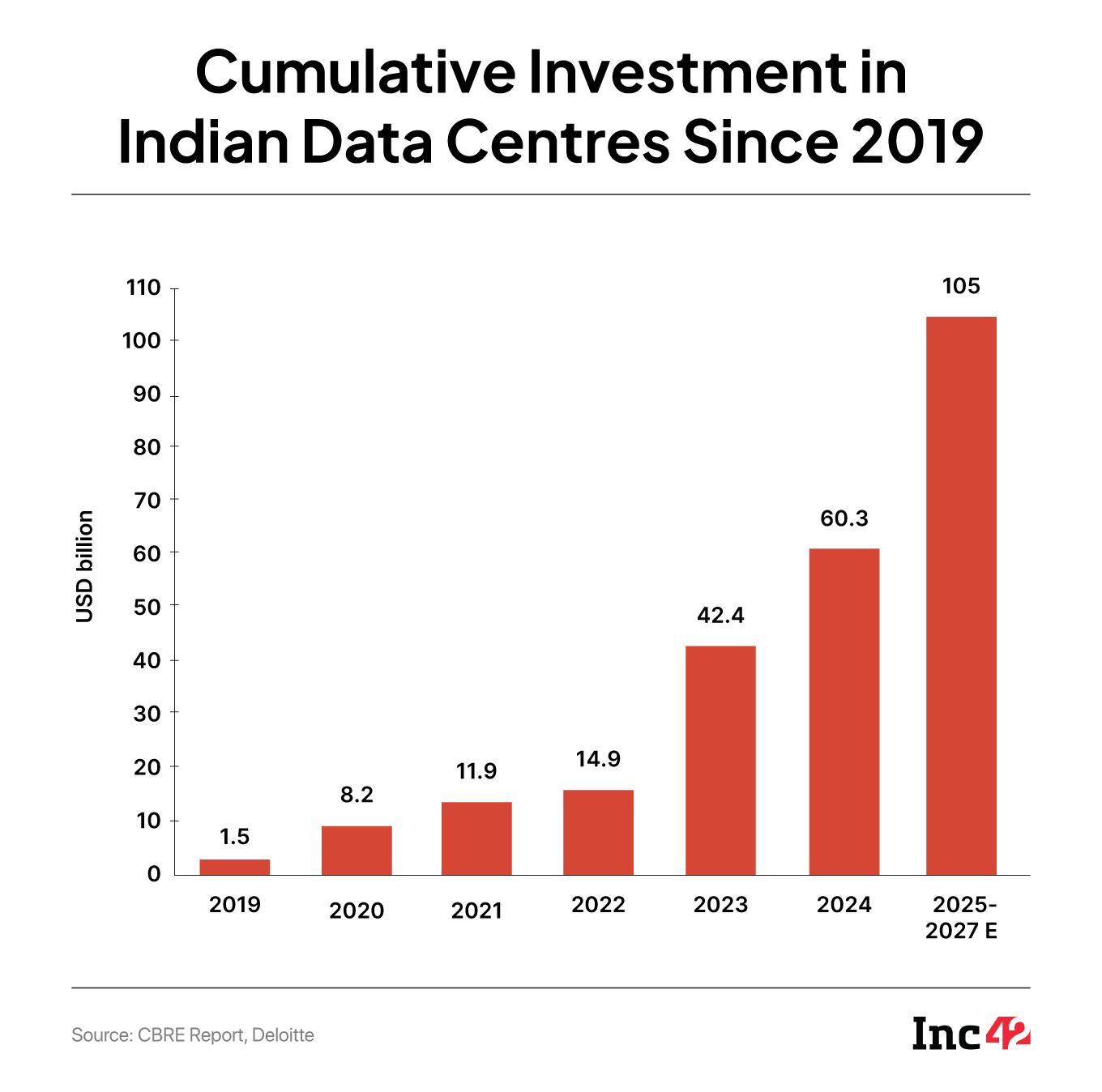

The country has 1.4 GW of operational data centre capacity, which is expected to double by 2027 and shoot off five-fold by 2030, Macquarie was quoted in media reports. And, the cumulative capital expenditure, excluding servers, to build this infrastructure is projected to range between $30 Bn and $45 Bn.

Inc42 took a recce of India’s evolving tech turf and tracked how the thriving AI ecosystem would drive the country’s digital economy in the coming years.

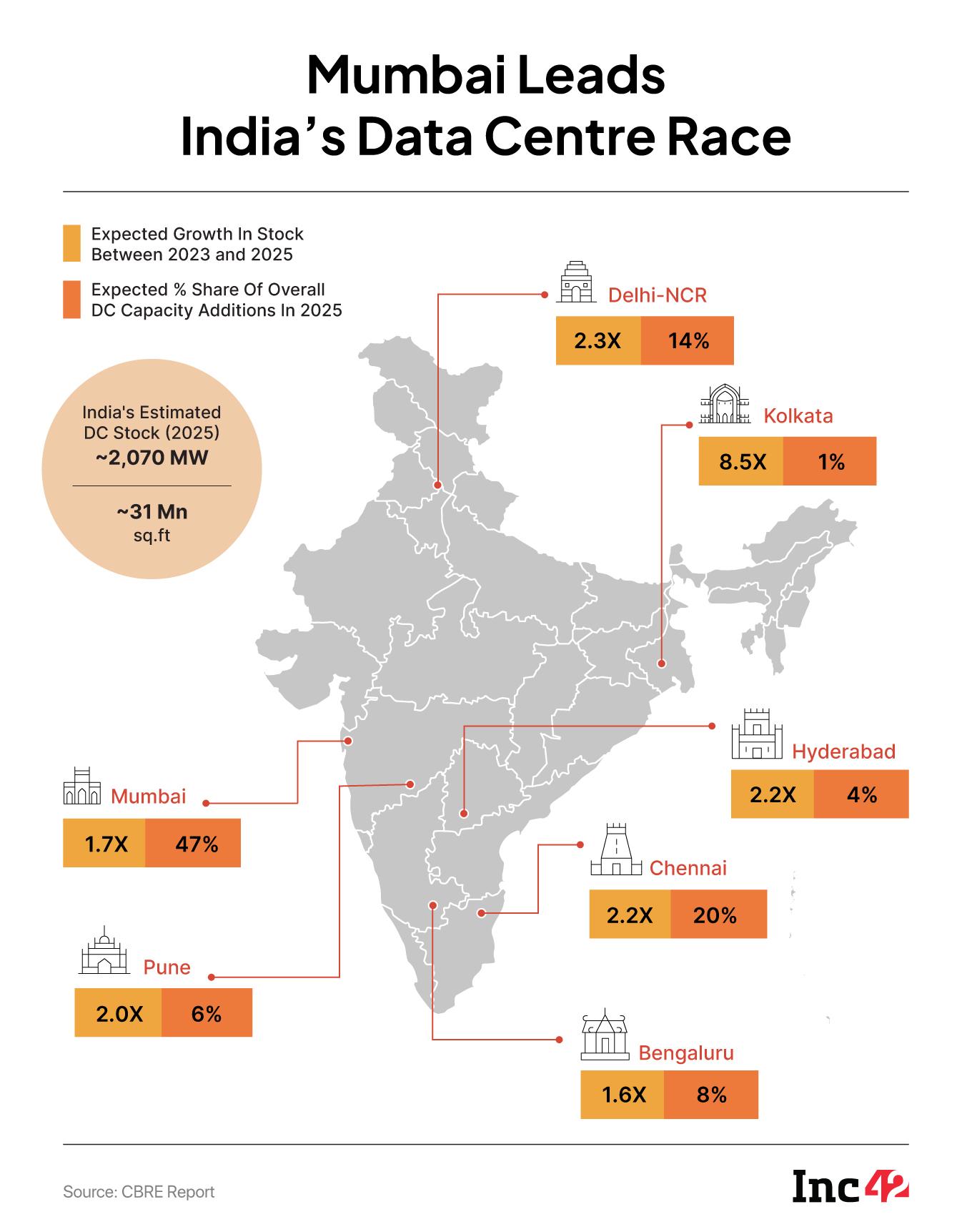

India’s Evolving Data Centre LandscapeBeyond codes, data centre is a game of concrete, chips, and cooling systems. The demand for capacity translates into a surge in construction. While the Indian market would require an additional 45–50 Mn Sq Ft of real estate space by 2030, the existing DCs may not be suitable for retrofitting as per GenAI needs and could be upgraded with additional capacity.

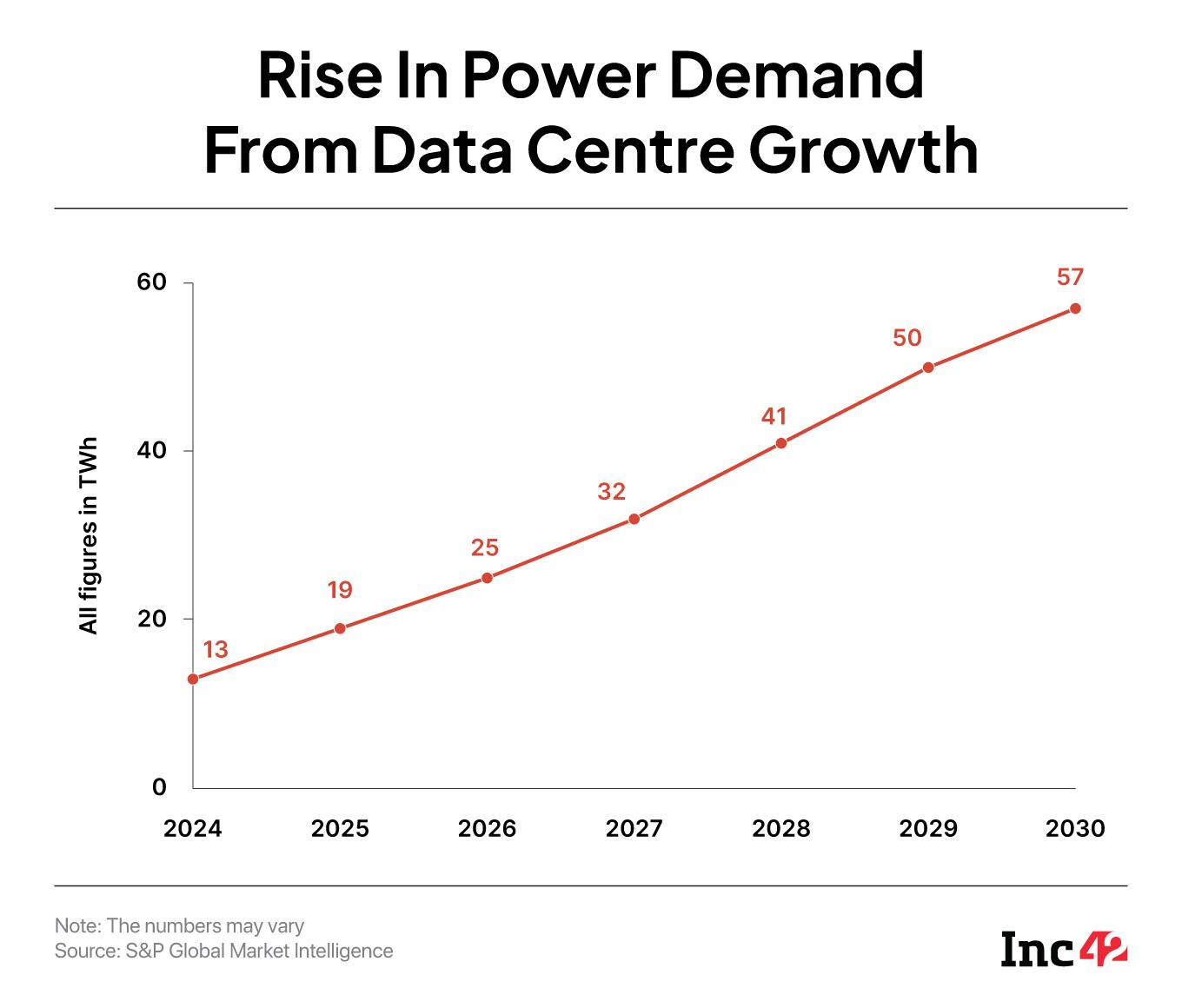

Brick-and-mortar is just one piece of the AI jigsaw. These data centres are power-guzzlers and the anticipated expansion will need more than 50 Terawatt Hours (TWH) of incremental power, which would be a three-fold rise in electricity demand to 2.6% by 2030. Power distributors or discoms and private utilities such as Reliance, Tata, and Adani, who also have their own DCs, are well-positioned to reap the best out of it.

The power play ambit expands to the green territory, too. With an increasing emphasis on renewable energy usage, the AI data centre boom will also benefit the solar and wind ecosystem, as well as battery storage providers.

At the other end of the value chain are enterprises and technology companies, including AI startups. Their need to store data locally, train models, and build sovereign AI capabilities will only add to the momentum.

Behind all the hustle over AI data centres in India, a defining trend is taking shape silently. It’s about growth in colocation data centres, where companies from financial services, manufacturing and other sectors are renting or leasing spaces to host their own servers. Giants like Google and Amazon Cloud Services also fall in this category. And, the growth of these big techs in India – earlier for cloud services and now for AI – has helped DC operators flourish.

From Yotta and IPO-bound Sify to BSE-listed TCC Concept subsidiary NES Data – a majority of the DC operators or infrastructure players provide colocation services.

Yotta’s Gupta told Inc42 that almost 80% of operators in the DC space are working at the foundational level or the colocation model. “Every AI data centre in India is typically a building capable of delivering the power, space, and cooling as per the customers’ AI GPU (graphics processing units) requirements. It doesn’t give GPUs, but it gives the right platform to host a GPU if you are the customer.”

The Indian AI ecosystem sees a new layer emerging – GPU-as-a-Service. As tech industry body Nasscom says, it provides access to GPU clusters through cloud, allowing organisations to provision resources as needed without massive upfront investments.

While Indian operators such as Yotta, E2E Networks, TCS, and Jio Platforms, offering GPU-as-a-service for AI training workloads, are already in the game, more companies are entering the fray, following the IndiaAI Mission’s emphasis on data sovereignty.

Geopolitical Unrest Shapes AI PlayAt a time when geopolitical tensions refuse to relent and India takes the centre stage in global supply chain, it is more pertinent than ever to ensure data localisation and sovereignty.

“As part of the IndiaAI Mission, where the government is outsourcing GPUs on a cloud model, they are very clear that GPUs have to be in India. And what is not being openly talked about, but privately admitted, is that they want the GPUs to be made available by local operators and not necessarily from foreign operators,” pointed out Gupta.

In fact, he said, following the Nayara Energy incident and a few others, the government is more resolute to prioritise India’s indigenous clouds. Microsoft had temporarily blocked Mumbai-based Indo-Russian oil company Nayara’s access to its digital infrastructure following European Union sanctions earlier this year.

As a result, new Indian players are emerging stronger. Yotta has partnered with NVIDIA to host its GPUs in its data centres and provide them as cloud services to enterprises and startups.

That, however, didn’t stop the American tech giants and new-age AI companies from beefing up their cloud infrastructure in India. They are, in fact, now entering the DC game, investing billions of dollars to develop physical hubs.

Google plans a $15 Bn AI and data centre in Visakhapatnam in partnership with AdaniConneX and Airtel to deliver gigawatt-scale computing power. OpenAI is also reportedly mulling a data centre in India with at least 1 GW capacity under its $500 Bn Stargate project, co-led by Masayoshi Son’s SoftBank.

Earlier this year, Microsoft announced its $3 Bn playbook for expanding its Azure Cloud and AI capacity in India. The company also purchased 48 acres of land in Hyderabad to expand its data centre business in the country.

Indian conglomerates, mid-size DC operators, and global big techs are set to gain significantly from the AI data centre boom. The larger picture, though, remains foggy, along with a few trade-offs.

Some discontent is palpable in small businesses. According to Umesh Sahay, the founder and MD of NES Data, despite the rush to set up DCs in India, there continues to be a lack of focus on enabling data storage at a cheaper cost for small and medium businesses, including startups, in the country.

“The reason OpenAI, Anthropic, or even Google and Microsoft are pushing for DC hubs in the country is because of their huge customer base here. They are preparing for the day when the government will mandate complete localisation of data,” he said, arguing that data storage is still expensive for SMEs and startups. “It can only be solved when more Indian players come into the data storage game with the emerging DCs.”

Sahay’s point of view unveils a significant growth driver for DCs – the data localisation mandate – that goes beyond the AI boom.

To meet the demand spiral, DC companies have started looking beyond urban India, in the Tier II and III towns. Experts believe that this will benefit the small-town economies by creating jobs, boosting realty, and paving the way for countless downstream industries.

Yet, there’s a clamour rising from the working class and IT professionals alike. The last two years have seen AI and automation replacing human labour at a large scale. The buzz in the air is that AI will replace at least 40% of jobs in the coming years. “By 2031, India’s technology sector stands at a crossroads: we could lose 1.5 Mn jobs or create up to 4 Mn new opportunities. The difference lies in the choices we make today,” India’s economic policy think tank Niti Aayog said in a report.

The prospects for long-term growth, however, can’t assuage the growing uncertainty over the short term. A spate of job-cuts by tech giants like Amazon and TCS has worsened the situation.

Even the green brigade sees red in data centre surge. There is a growing concern around increasing power consumption and water usage by data centres. Increasing construction activities too are raising concerns among ecologists.

The demand for electricity from data centres is likely to surge 50% across the world by 2027 and 165% by the end of the decade. In India, which is primarily reliant on coal and fossil fuel, the increase of data centres by gigawatts and terawatts will come at a cost to the environment unless steps are taken at the right time.

DC providers said they are taking the environmental aspect seriously. Yotta’s MD claimed that 80% of total energy consumption at its Mumbai campus was from green sources, which is 100% in its Delhi facility. “On behalf of the industry, I am saying that almost every industry player is doing their best to maximise renewable energy use,” he said.

But, does India have enough green power supply and infrastructure to make this shift possible? DCs account for about 2% of greenhouse gas emissions, equal to the aviation industry. Given that there is a requirement for more efficient grid systems, transformers, and other infrastructure facilities, it doesn’t appear to be easy to pull off.

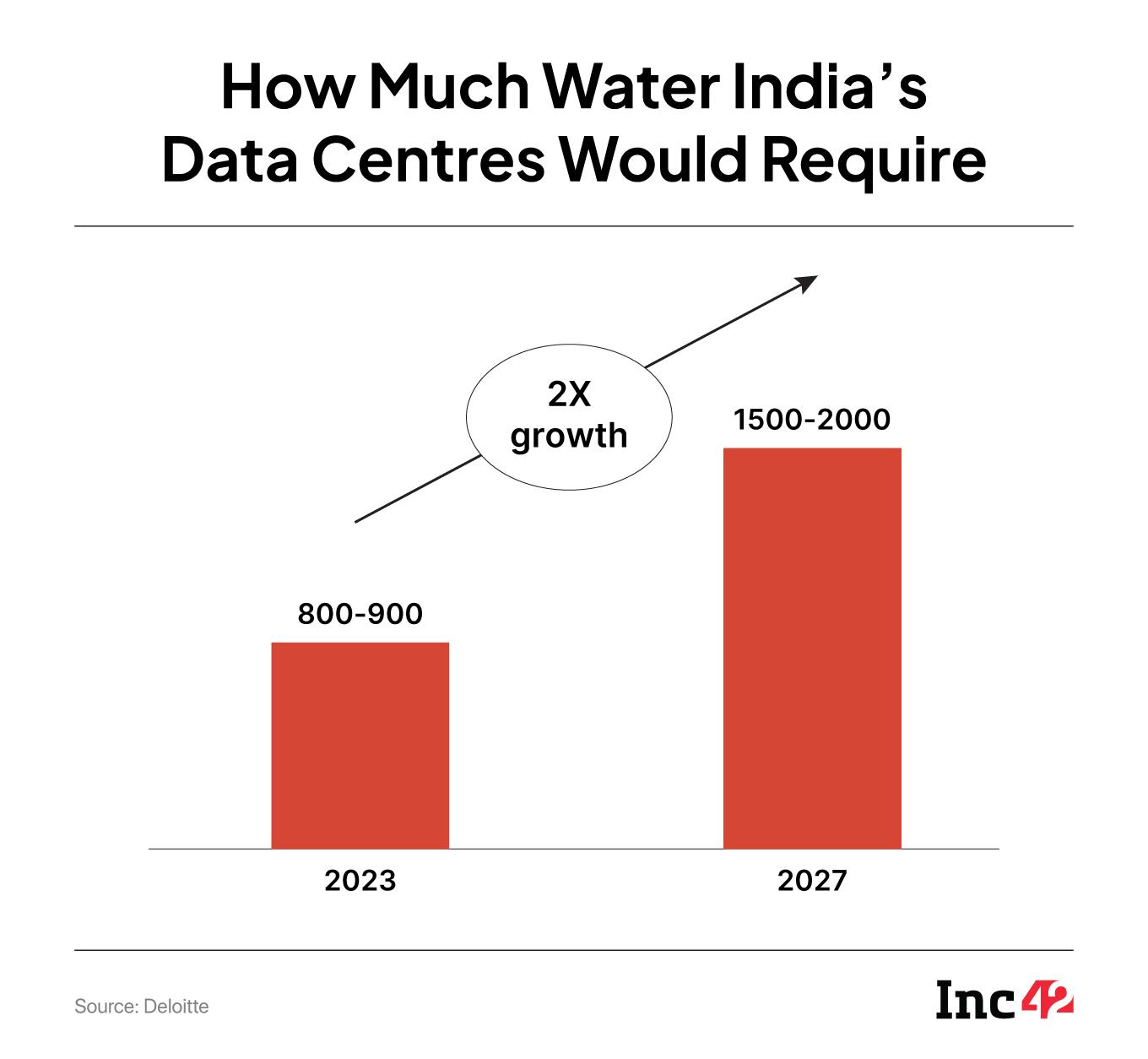

Cooling is another major challenge. A 1 MW data centre usually consumes around 68,500 litres of water a day, which can run up to 5 Mn gallons of water per day for larger DCs. This is equivalent to the water used by a town with a population of 10,000 to 50,000. For ChatGPT to write a 100-word email, it takes half a litre of water. In a world where 2.1 Bn people lack access to safe drinking water, with the number standing at 163 Mn in India, the consumption of this huge amount of freshwater by data centres continues to raise concerns.

Vasudha Madhavan, founder of climate tech investment firm Ostara Advisors, believes that to solve the growing energy demand, companies have to think of running the data centres and cooling them more efficiently. “It could mean building AI algorithms that are token-efficient, or that ensure a more efficient use of compute. It could at least mitigate the demand for energy.”

The biggest cost of cooling is air-conditioning, where refrigerants are used that are not good for the planet, and electricity is being constantly used. “We have to support innovations in this field for alternative advanced cooling techniques,” she said.

Yotta’s Gupta played down water as a cause for concern in India. “In the case of water-based chillers, there is a need for a constant supply of freshwater. In India, most buildings have air-cooled chillers, where water consumption is almost negligible.”

The data centre boom has fostered a fallacy of sorts, with arguments over job losses and job creation, power guzzling and green power, and water consumption and water abundance going louder by the day.

A Dream Stuck In The AI ParadoxShould India ride this wave to make its dream of becoming an AI hub for the world or it would simply remain the backroom boy for the world in its AI journey?

As billions are being poured into the AI playbook, the ghosts of urbanisation and industrialisation return to drive India back to the crossroads where it witnessed the displacement of millions of people, loss of green cover stretching thousands of acres, and large-scale unrests.

Development is undeniable. And, India is pursuing its $5 Tn economy dream with policies and schemes that are conducive for its aspiration to be the global AI hub. But, sustainability cannot be an afterthought, instead of being the guiding principle, for the world’s fourth-largest economy in its Viksit Bharat mission.

The challenge is not about building more data centres, which will naturally happen with more capital flowing in and more policies backing it. The challenge is rather about building them responsibly, ensuring real employment, data security that the country is aspiring for, and protecting the environment so that India’s digital transformation doesn’t repeat the mistakes of its industrialisation drive.

[Edited by Kumar Chatterjee]

The post AI Data Centre Boom Unfolds A $18 Bn Battlefront For India appeared first on Inc42 Media.

You may also like

Big Apple has fallen far from its capitalist tree – to a socialist

LeBron James' wife Savannah James explains how one simple organizing ritual turned into her secret beauty tip

Women's ODI WC Winning Indian Team To Meet President Droupadi Murmu On Thursday

Establishment of National Law University a historic milestone: CJI Gavai

Algerian 'sex offender' accidentially released from prison is migrant who overstayed visa