In further troubles for Gensol, its lenders Power Finance Corp (PFC) and Indian Renewable Energy Development Agency (IREDA) are reportedly planning to take legal action for recovering their loans from the EPC company.

The promoters of Gensol, Anmol Singh Jaggi and Puneet Jaggi, are also the .

A report by ET said that the two public sector lenders will await the results of the ordered by the Securities and Exchange Board of India (SEBI) in an interim order. The markets regulator said that Gensol and its promoters diverted the company’s funds and were involved in manipulation of share price.

In its investigation, SEBI found that Gensol defaulted on INR 57.9 Cr debt from IREDA and INR 13.67 Cr debt of PFC.

Gensol availed term loans to the tune of INR 977.75 Cr from IREDA and PFC between FY22 and FY24. Out of these loans, INR 663.89 Cr was meant to buy 6,400 EVs to be leased to BluSmart. However, the company only purchased 4,704 vehicles. The SEBI order said that even though the company availed the last tranche of the said loan more than a year ago.

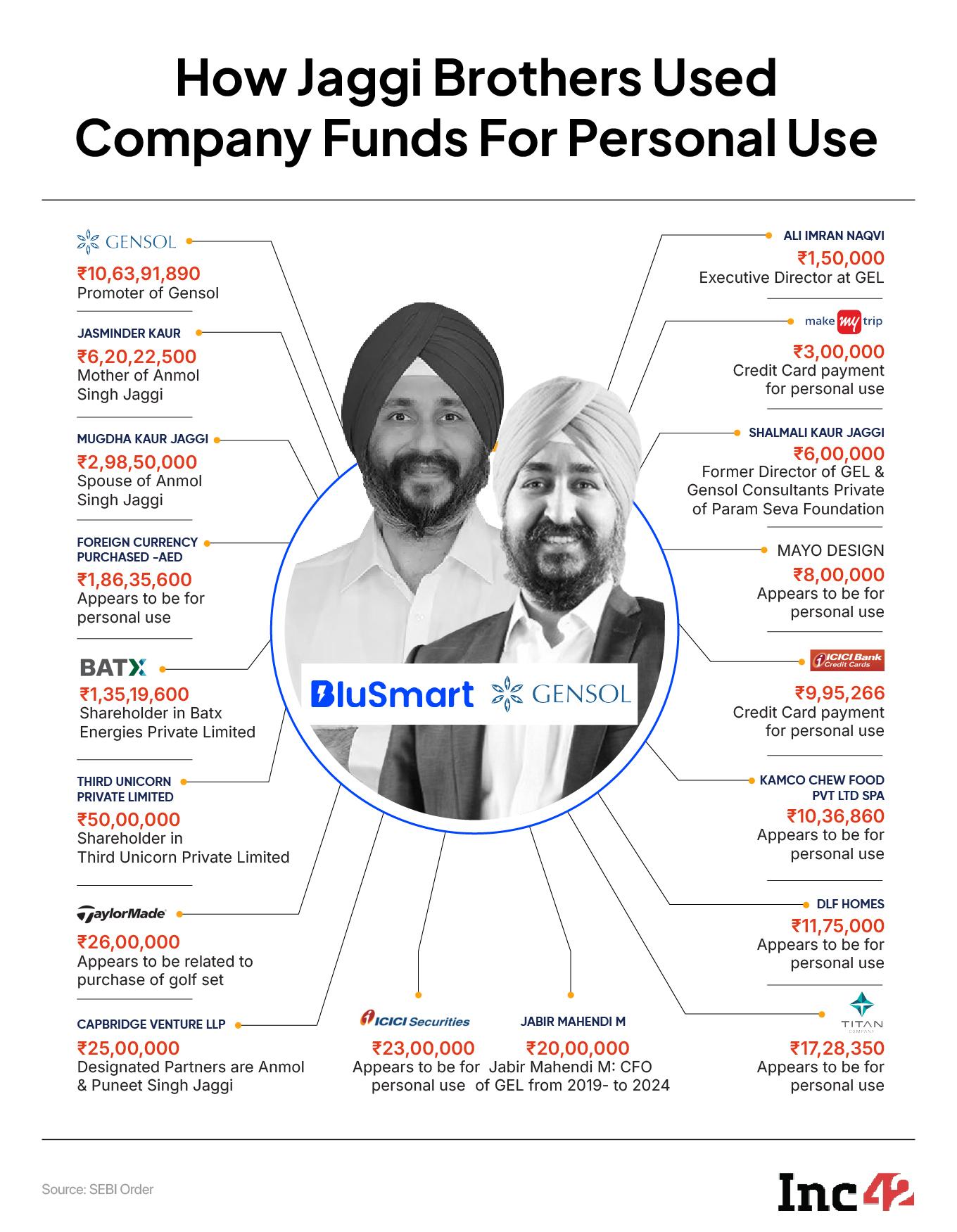

Diversion Of Funds & Other AllegationsFurther, it was found that the funds were diverted for personal use of promoters and their family members, including mother of Anmol Jaggi and his wife. Further, a part of it was also used to make an investment in Ashneer Grover-led Third Unicorn Private Limited and purchase property in DLF’s luxury project ‘The Camellias’.

The company also resorted to fooling credit rating agencies (CRAs). When the CRAs asked the company for loan statements, it provided all the statements except pertaining to IREDA and PFC. On the contrary, it provided ‘conduct letters’ purportedly issued by them which stated that it was regular in its debt servicing. However, the creditors denied having provided any such letters.

The rating agencies, CARE and ICRA, had given a ‘D” category rating or a ‘status of default’ to Gensol in March.

The ET report said that the two lenders have also sent show-cause notices to Gensol, seeking to know how the conduct letters were issued on their behalf.

A day after SEBI’s order, which also barred the Jaggi brothers from holding the position of a director, some of its independent directors also left the sinking ship. Arun Menon, Harsh Singh and Kuljit Singh Popli yesterday.

Meanwhile, the crisis has also hit Gensol’s related entity, BluSmart. The startup in all cities it operates in, including Delhi NCR, Mumbai, and Bengaluru. Earlier, a report said that BluSmart may exit its core ride-hailing business and transition to operating as a fleet partner of its rival Uber.

BluSmart has raised a total funding of $136 Mn to date from investors like Venture Catalysts, Stride Ventures, and responsAbility.

The post appeared first on .

You may also like

India's pharma exports surpass $30 billion in FY25, US top market

IPL 2025: Gujarat Titans ask Delhi Capitals to bat first in Ahmedabad

Indian stock markets rally over 4.5 pc in holiday-shortened week

Nothing to ramp up exports from India amid global trade uncertainty: CEO

Elon Musk's Upcoming Visit to India: What to Expect from the Tech Titan?