Last week, the Indian startup ecosystem witnessed a different kind of distress sale. Typically speaking, such deals involve companies going through a downturn, but this time it was for an IPO-bound company — Ecom Express.

Listed major that it is acquiring 99.4% stake in Ecom Express for INR 1,407 Cr ($165 Mn), an almost 80% valuation drop from Ecom Express’s last valuation of INR 7,300 Cr ($850 Mn).

The deal will go down in history for two reasons. Firstly, this distress sale is arguably the most severe of its kind in Indian startup history. Global marquee investors are expected to take a massive loss in the exit — as we will see.

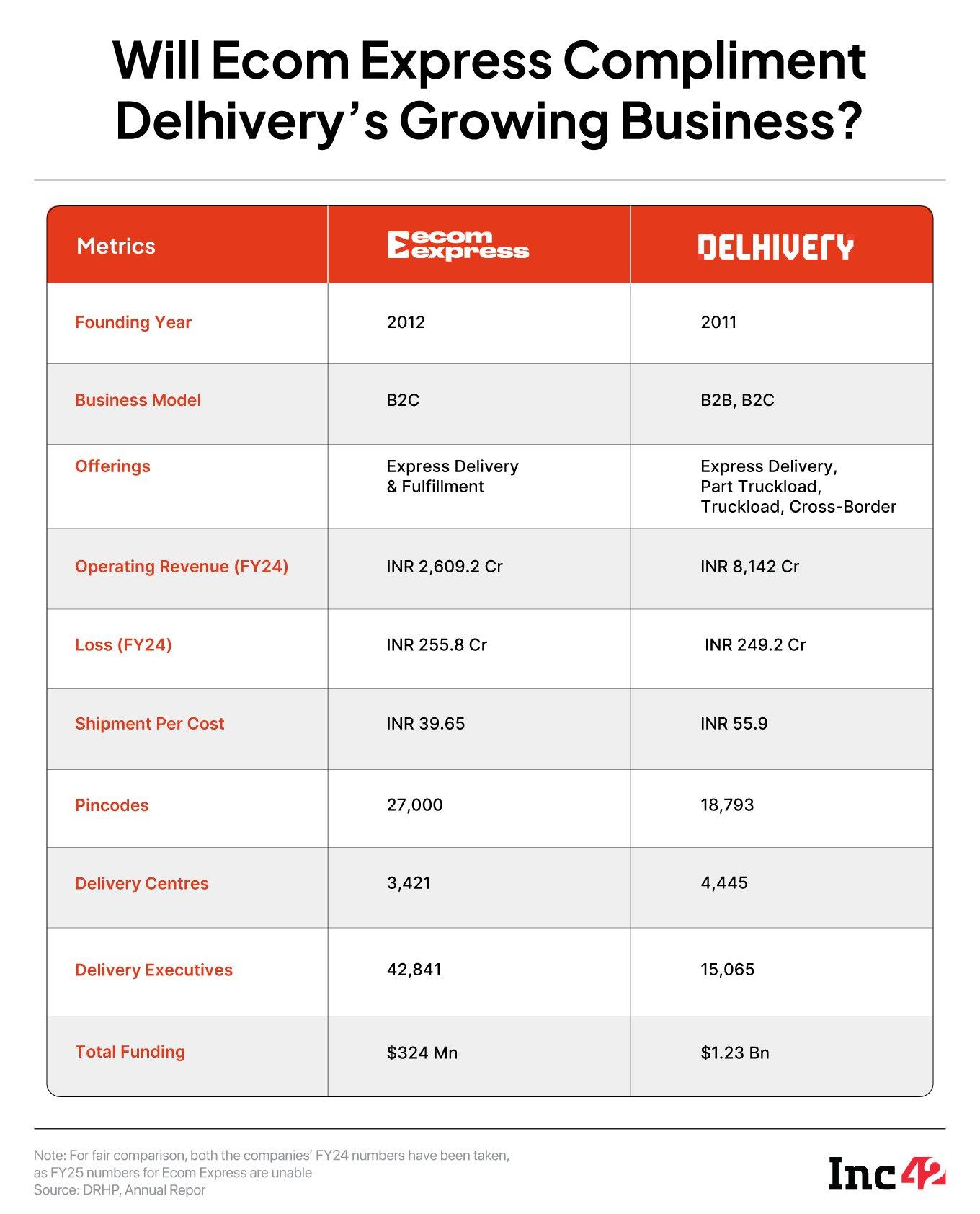

And the second: Delhivery, an arch rival for Ecom Express, is the one giving some form of a lifeboat and in the process acquiring a bigger piece of the market share. However, as a result of this acquisition there are grave consequences in store for thousands of employees at Ecom Express, who are likely to take the worst hit in this deal.

If we have to track the distress for Ecom Express, we have to go back to the company’s initial plan in , which was eventually shelved.

This was soon followed by the . And almost immediately after that Ecom Express found itself without its biggest customer. This is how the past 14 months have unfolded for the company:

- February 2024: Meesho, Ecom Express’ biggest customer, launches an in-house logistics vertical Valmo

- June 2024: Ecom Express shelves plans to raise INR 400 Cr at $1 Bn+ valuation from existing investors, raises INR 1,400 Cr via rights issue

- August 2024: with an aim to raise INR 2,600 Cr from public market after withdrawing first bid in 2022

- September 2024: Delhivery alleges and hid costs in its representations to investors and regulators

- December 2024: Meesho reduced almost 40%-50% of shipment volume with Ecom Express

- January 2025: Several Ecom Express’ clients, including Reliance and Amazon, significantly reduced their orders, according to sources

- February 2025: Shelves IPO plans for a second time; over 500 employees laid off and 1,000 delivery centres shut down

- March 2025: Archrival Delhivery announces acquiring 99.4% stake in Ecom Express for nearly half of its targeted IPO valuation

Ecom Express, which claims to have handled over 2 Bn shipments since inception and reached around 97% of the country’s population, is in a dire situation, with revenue declining in FY25 and losses growing.

What exactly went wrong for Ecom Express, especially after it was one of the first companies in this space to hit profitability?

Delhivery, Ecom Express, and its investors, such as Partners Group, Warburg Pincus, and British Investment International, did not respond to Inc42’s queries.

Founded in 2012 by the late TA Krishnan, Manju Dhawan, K Satyanarayana and Sanjeev Saxena, Ecom Express offers shipping and fulfilment services for ecommerce brands and B2C marketplaces. It claims to have 3,000 delivery centres with a network that spans 2,700 cities and towns across India.

Till date, it has raised more than $324 Mn in funding from global marquee VCs and private equity funds, including Warburg Pincus, British International Investments (BII), Partners Group and others, across 12 funding rounds, and was last valued at around $850 Mn in 2022.

In fact, Ecom even turned profitable in FY21, well before its competitors, which was an encouraging sign in a sector that has cut-throat competition, low margins, and high operational cost.

For context, Delhivery reported its first ever profit in, and Ecom’s other competitor, Xpressbees is yet to book its first profitable year since inception in 2015.

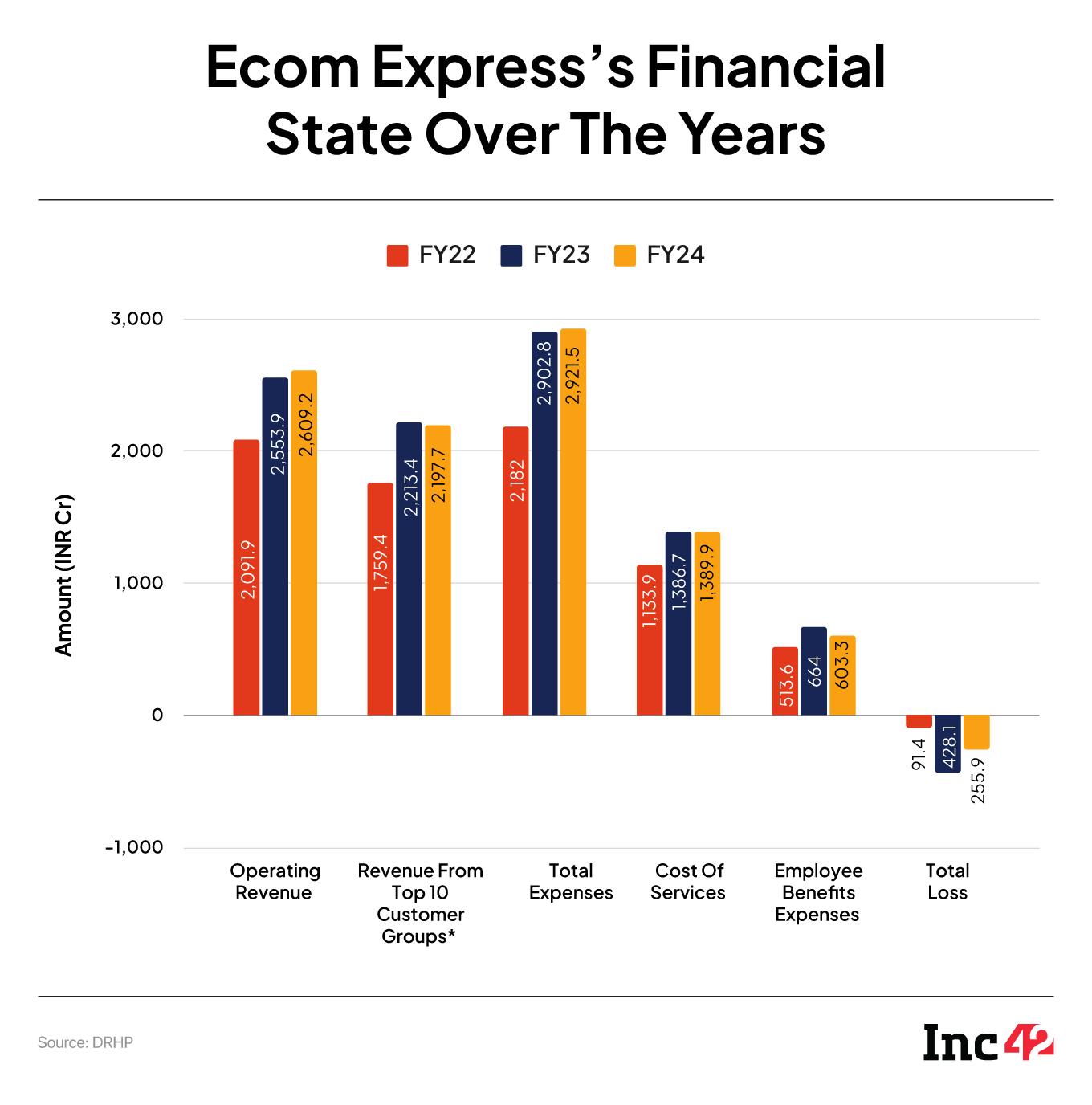

However, cut to 2024 and the picture is different. Ecom Express saw its revenue increase by mere 2.3% to INR 2,653 Cr in FY24, from INR 2,554 Cr a year ago. This growth was the slowest among the competition.

Despite this, by August 2024, Ecom Express had come back to the IPO table after the failed first attempt in 2022. However, as sources have now told Inc42, the DRHP only revealed what Ecom Express wanted to show to the market.

For instance, it didn’t mention that Ecom Express’ biggest customer Meesho was clearly moving away from the company. Nor did it mention anything about how the company’s service quality was hampered by the exit of key leaders from late 2023.

As per Delhivery’s latest exchange filing dated April 11, 2025, Ecom Express reported operating revenue of INR 1,912 Cr in the first nine months of FY25, which would take it close to INR 2,500 Cr in terms of full year revenue, or back to FY23 level.

Moreover, the startup saw net loss increase to INR 398 Cr in this period, with an operational loss of INR 184 Cr. This raises even more questions about why Delhivery is acquiring the company?

“The January to March quarter revenue has fallen by 30% YoY, as the company saw more of its clients pull out,” according to an industry insider aware of Ecom Express’ situation.

The first trigger was Meesho.

Meesho’s Breakaway Move That Broke Ecom ExpressIn late 2023, Ecom Express was busy improving its infrastructure and operations by launching same-day, next-day and express deliveries to fulfill the changing needs of D2C players and ecommerce marketplaces. Then its biggest customer — Meesho — became a competitor.

Ecommerce giant Meesho launched its very own logistics vertical Valmo in early 2024 after months of testing to cut operational costs, and this left a big dent in Ecom’s revenue prospects.

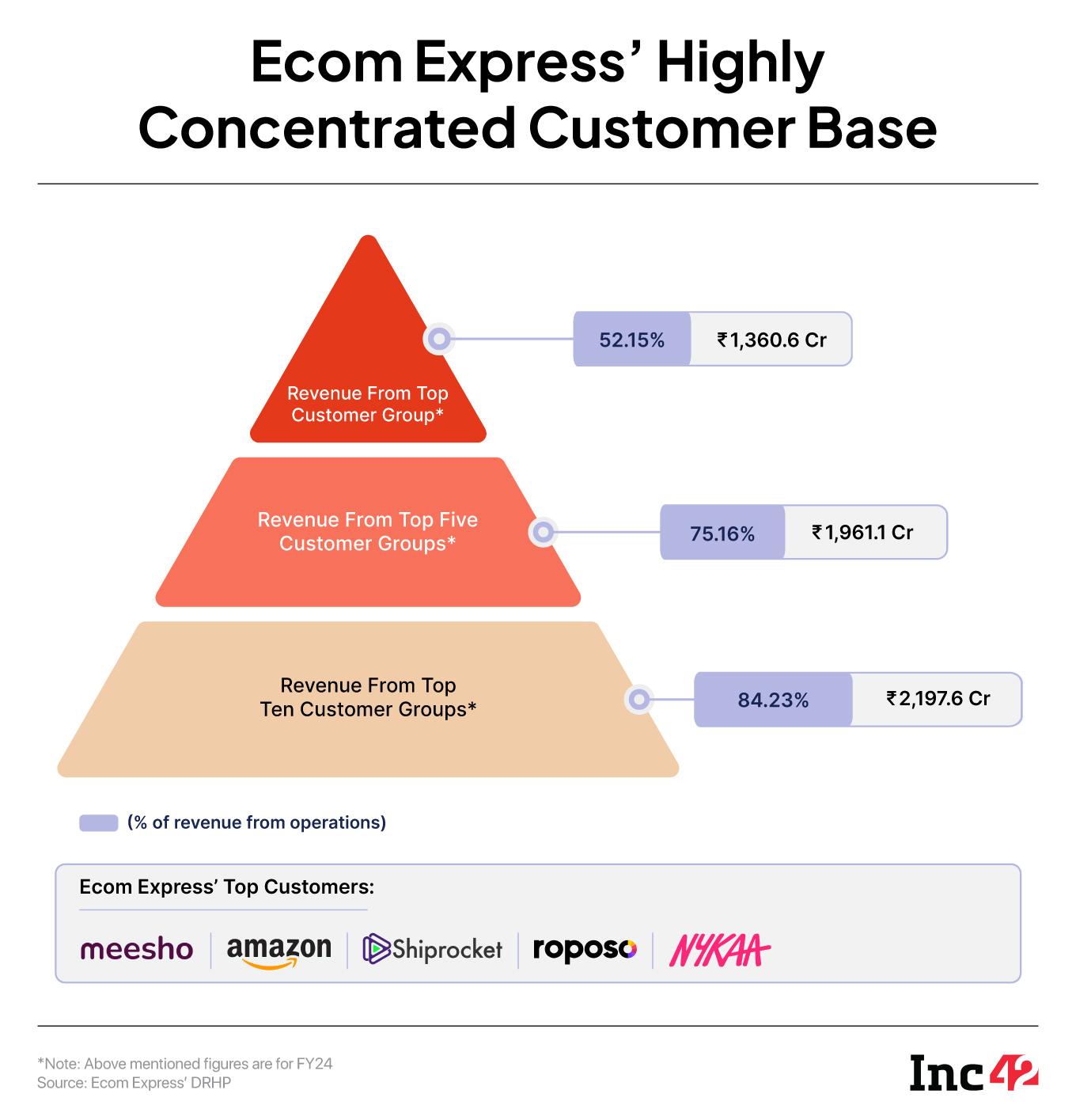

As per Ecom Express’ DRHP, the company made 52% of its revenue from a single customer, which is most likely to be Meesho.

The company’s DRHP, filed in August 2024, said that in the past, the business had seen a significant impact from a major customer withdrawing its business.

It would not be a stretch to say that Ecom Express’ revenue growth between FY22 and FY24 was largely driven by Meesho. In FY22, Ecom Express’ largest customer brought in 29% of all revenue, which nearly doubled in FY24.

This spike coincided with Meesho’s transition towards a full-blown marketplace rather than an affiliate platform with some bits of fulfillment and seller services sprinkled in. When Meesho took full control of the logistics like any other marketplace, Ecom Express was left with a big hole in its roof.

While such a heavy reliance on one customer is always risky, it had other customers such as Amazon India, Roposo, Shiprocket and others that offered the potential for growth. However, just as Meesho gradually pulled its business away from Ecom Express, others did too.

While such a heavy reliance on one customer is always risky, it had other customers such as Amazon India, Roposo, Shiprocket and others that offered the potential for growth. However, just as Meesho gradually pulled its business away from Ecom Express, others did too.

It is not unusual for logistics companies to have a large reliance on a small set of customers. However, this needs to be reduced over a period of time. Delhivery’s top five customers contributed 38.4% of revenue in FY24, down from 48.8% in FY19.

Sources claim the lack of revenue diversification was a problem that Ecom Express had encountered earlier and the company didn’t learn from its mistakes in the past. The company is said to have faced a similar situation when abruptly exited India in 2022.

In 2024, without Meesho, Ecom Express had a problem of excess resources and a wide network that was not being utilised efficiently. It also saw an exodus of long-time employees and key leaders.

A Tragedy And Key ExitsAfter the demise of former CEO Krishnan in October 2023, Ecom Express brought in former Airtel Business chief Ajay Chitkara as the managing director and CEO.

Chitkara, who came with no prior experience in the logistics industry, was tasked to take the company to a public listing at the earliest, according to sources.

“Chitkara’s primary target was to increase order volume and resume the IPO process, which was shelved two years back,” said one of the sources on the condition of anonymity.

As per industry sources, one of Chitkara’s first measures was slashing down the delivery cost by 30%, causing a stir in the industry and prompting other companies to cut their prices too. This naturally resulted in higher volumes, but put a strain on the infrastructure and impacted quality of service.

Incidentally, within a year of Chitkara’s appointment, several department heads and CXOs departed the company, allegedly due to differences with Chitkara’s approach.

- Dipanjan Banerjee, who was the chief business officer for over eight years, exited and joined BlueDart as chief commercial officer

- Prashant Gazipur, country head operations and chief process officer at Ecom Express left and joined Delhivery as senior VP

- Sonam Paliwal, who looked after hub and network operations at Ecom Express, quit to join as director of operations at DTDC

These exits severely impacted day-to-day operations, and while Ecom Express had massive team at its disposal, the new leadership was more focussed on growing volumes.

Sources in the industry point to regular delays in deliveries to customers, delivery fraud and an overall sub-par customer experience with Ecom Express.

For example, a cursory search of “Ecom Express” on social media will yield posts by disgruntled customers narrating their poor experience around orders, late deliveries and more.

As per another industry insider, Reliance was the first one to express its dissatisfaction with Ecom Express’ service quality, and the rest followed. “By the end of 2024, most clients cut their business with Ecom Express and moved to competitors. This heavily affected the topline and profitability,” said a source.

Dropping The B2B BallFor years, Ecom Express’ singular focus on the B2C ecommerce market was seen as an advantage in the logistics tech space. Umesh Chandra Paliwal, CEO of unlisted trading platform UnlistedZone, had earlier told Inc42 that Ecom Express enjoys higher margins compared to Delhivery, which had a more diversified business, and in the long run, this is preferred.

Up to 80% of Ecom Express’ business was concentrated in Tier 1 and 2 cities where delivery costs are considerably lower than rural areas or remote locations. This gave it something of an edge on margins and commissions from brands.

But without its biggest customer Meesho, the stubbornness to not venture beyond B2C deliveries became a thorn in the startup’s growth arc.

“Diversification is a must when you are heading for an IPO. What Ecom Express did was too risky, especially when your largest client becomes your competitor,” said another industry insider in the space, adding that it was “red flag” for anyone who was looking at investing in the IPO.

While Delhivery continues to generate 62% of its revenue from B2C deliveries, it has also added B2B and cross-border deliveries to the mix. FirstCry-owned Xpressbees has also diversified beyond B2C and ventured into cargo and B2B areas.

“Meesho was a major client for other logistics players too, but having diversified businesses and multiple revenue streams cushioned the likes of Delhivery from getting severely impacted,” another source highlighted.

Even if we talk about ecommerce deliveries, Ecom Express stood second with 27% market share with 514 Mn shipments, as per the industry report section in its DRHP — numbers that have to be taken with a grain of salt.

Moreover, Ecom Express claimed to deliver products in 27,000 pin codes, while as per India government the country has around 19,300 pincodes, excluding army postal services.

Soon after the DRHP was released, shipments stood at about 450 Mn when adjusted for return to origin (RTO) shipments.

The claim was that Ecom Express had counted the initial shipment to the customer and the RTO as two shipments, whereas the industry norm is to record it as one shipment. Ecom Express never responded to this claim publicly.

What’s also clear is that the startup was never able to capitalise on the growing popularity of quick commerce like its competitors such as Shadowfax, which have partnered with brands to facilitate 10 to 30-minute deliveries.

Real Synergy Or A Baggage In The Making?With several red flags in the company’s DRHP that would eventually need to be addressed closer to the IPO, Ecom Express was running the risk of a dud listing. It seems that the company was left with little choice than to provide an exit to investors through an acquisition, and found a rescue act in Delhivery.

According to a VCCircle report, Partners Group, which had invested over $250 Mn in Ecom Express and owns just under 50% stake, is set to make a 71% loss on its investment in the exit. Similarly, British Institute of Investment (BII), which has 10% stake, will exit at a 70% loss.

Inc42 did not receive responses from any investors and shareholders of Ecom Express about the extent of their losses and the state of their investment.

Incidentally, Ecom Express CEO is in line to receive a bonus of up to INR 15 Cr if the company gets listed or gets acquired, as per details seen by Inc42.

While it is not yet clear how the acquisition will pan out, we know that the company’s workforce is close to 50,000, with the majority being part-time delivery partners. The company employs around 16,000 full-time workers to manage the operations, engineering and technology teams, sales and marketing and other central functions.

Their fate remains unknown, but it’s unlikely that Delhivery will absorb all the jobs. Some roles would be redundant while others might not fit within Delhivery’s operational wheel.

While Delhivery is ambitious and says that the acquisition is expected to make “steady state profits” on retained revenue, assumed to be ~30% of FY25 base, it’s also not clear whether Ecom Express will remain independent of Delhivery, but this scenario seems highly unlikely as Delhivery is the bigger brand and there’s no clear need for a multi-brand strategy in this space unlike ecommerce or SaaS.

Moreover, Delhivery has only just started showing profitability. It’s not exactly clear how much revenue Ecom Express will be adding to its business, even though the acquisition would definitely add to the costs.

Delhivery’s experience with the previous acquisition of Spoton was also not great. Integrating that acquisition was a major challenge for the company and it resulted in unsavoury complications at the management layer. In this regard, Delhivery claims there is significant operational overlap with Ecom Express to prevent such an issue.

The one thing that could count in Delhivery’s favour is that with thinning competition in this space, it can dictate the pricing to some extent. However, given that the likes of Meesho’s Valmo, Xpressbees, Shadowfax and others are expanding in the logistics space, this advantage could be short-lived.

[Edited By Nikhil Subramaniam]

The post appeared first on .

You may also like

Lesser-known fruit lowers blood pressure, chronic inflammation and ageing issues

FEMA staff face lie detector tests amid DHS leak probe, fears of agency overhaul

Michelle Keegan shares sweet tribute to baby Palma after admission about name

The beautiful Italian seaside spot that's 18C in April and the 'Maldives of Europe'

The world's 'largest' river that doesn't have a single bridge across it - for 2 reasons